2025 European and American Residential Energy Storage Market Forecast: Opportunities and Risk Management Strategies

As a Chinese manufacturer specializing in residential energy storage batteries, we closely monitor the dynamics of the global energy transition. In 2025, the European and American residential energy storage market is at a critical juncture: on the one hand, driven by the popularization of renewable energy and surging electricity demand, the market size continues to expand; on the other hand, policy uncertainty and supply chain challenges bring potential risks. This article analyzes forecasts, opportunities, and risks based on the latest industry reports and data, and proposes management strategies. We welcome industry peers to exchange views!

Market Forecast: Strong Growth but Slowing Growth Rate

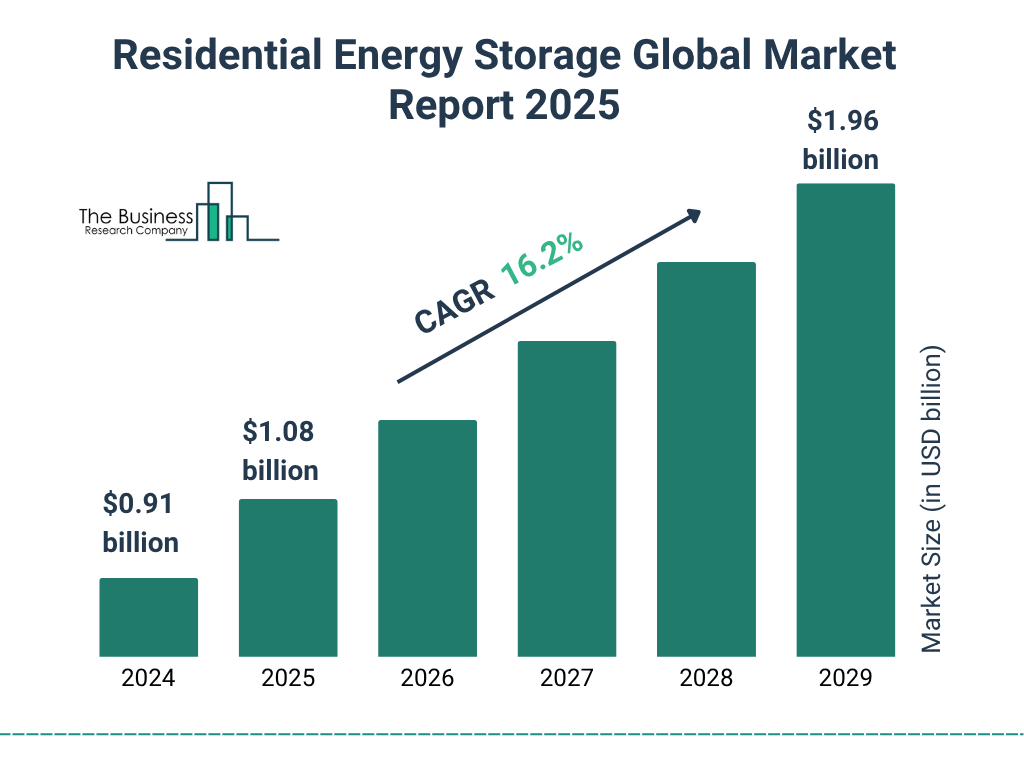

The global residential energy storage market is expected to exceed US$15 billion in 2025, with a compound annual growth rate (CAGR) of over 20%. This trend is particularly pronounced in Europe and the Americas.

European Market: The residential energy storage market remains resilient, with significant growth in medium-sized and emerging markets (such as Germany, the UK, and France). Although EU solar installations are expected to decline by 1.4% (the first negative growth), energy storage demand benefits from utility-scale projects and residential solar pairings. Wood Mackenzie predicts that residential energy storage installations in Europe will continue to grow, benefiting from targeted support programs and utility procurement, with utility-scale installations expected to surpass residential installations in 2026. Germany, as a leading market, is driving installations through KfW subsidies, and strong residential battery capacity growth is expected in 2025. Emerging markets such as the Netherlands and Spain are benefiting from solar + storage projects, with overall utility-scale installations in the EMEA region (Europe, Middle East, and Africa) growing by 35%.

In the US market, residential energy storage growth is five times that of 2020, reaching 4.8 GW in 2024, and is projected to increase by another 4 GW by 2026. Utility-scale installations are expected to reach 16.2 GW (a 49% increase from 2024), with total operational capacity reaching 37.4 GW by October 2025 (a 32% year-on-year increase), and another 19 GW under construction until 2026. Hotspots like California are benefiting from policy changes, driving residential deployments; total installations are projected at 87.8 GW from 2025 to 2029, but policy adjustments could reduce this by 16.5 GW.

Overall, residential energy storage in Europe and the US benefits from solar pairings (over half of US utility storage is combined with solar), but global new capacity reaches 94 GW (247 GWh), with a CAGR of 14.7% to 2035.

Opportunities: Technological Innovation and Demand-Driven

In 2025, opportunities in the European and US markets primarily stem from accelerated energy transition and cost reductions.

Surge in Demand: Data center and electrification demands are driving energy storage deployments. US hyperscale data centers account for 90% of global carbon-free energy contracts, with energy storage serving as a 24/7 clean energy bridge. European grid instability and weather events are increasing backup demand, with virtual power plants (VPPs) integrating batteries into grid services, generating additional revenue in Germany, Australia, and the US. Residential solar power and energy storage integration is becoming standard, with LFP batteries dominating (safety, lifespan exceeding 8000 cycles), and costs dropping to $400-900/kWh.

Policy and Innovation Support: The US Investment Tax Credit (ITC) continues to 2035, while European KfW subsidies and Australian rebates reduce initial costs. Technological advancements include AI-powered intelligent energy management systems (EMS) optimizing charge and discharge, and long-term energy storage pilots (such as 48-hour hydrogen-lithium hybrids). Emerging markets like Saudi Arabia and South Africa are expanding utility projects, providing OEM opportunities for manufacturers. Price arbitrage is prevalent in the US, with 50% of utility batteries in the ERCOT market used for this purpose.

Market Expansion: Distributed energy storage is growing, with FERC Order 2222 accelerating the aggregation of distributed energy resources (DERs) in the wholesale market, reaching 30 GW of VPP registrations by 2024. For manufacturers, modular design and compatibility with power tool batteries will be key differentiators.

Risks: Policy Uncertainty and Supply Chain Challenges

Despite strong growth, risks in 2025 cannot be ignored, primarily due to geopolitical and policy influences.

Policy Risks: US Trump policies (such as the One Big Beautiful Bill Act) introduce Foreign Entity of Concern (FEOC) restrictions, requiring projects to source 55% of materials from non-FEOC sources starting in 2026 (increasing to 75% by 2030). 83% of planned 219 GW grid-connected energy storage projects may lose their International Time Concern (ITC). Increased import tariffs (up to 145% for Chinese products) will lead to a 30% increase in system costs to $266/kWh, potentially reducing installations by 51-74% between 2025 and 2027. European solar amortization impacts residential installations, and policy changes (such as China shifting to market-based payments) could disrupt the global supply chain.

Supply Chain and Cost Risks: Material volatility (e.g., cobalt, nickel), while LFP (Limited Product Supply) eases, exacerbates China's import dependence and trade barrier risks. US anti-dumping duties target battery imports, leading to frequent project delays. Insufficient recycling infrastructure and low regulatory maturity in Europe affect VPP (Vehicle-to-Private Partnership) participation.

Other Risks: Project permit delays, component shortages, and declining installation rates starting in 2026.

Risk Management Strategies: Diversification and Localization

Faced with uncertainty, manufacturers and investors can adopt the following strategies:

Supply Chain Diversification: Reduce reliance on China and shift to US-based or non-FEOC sources (e.g., LG Energy Solution in South Korea expanding to 16.5 GWh). Explore hybrid procurement and EV battery reuse.

Policy Adaptation: Secure ITC-eligible projects in advance and utilize leasing/PPA models to circumvent 25D credit expiration. Monitor EU supply chain regulations and participate in local recycling programs.

Technology Optimization: Prioritize LFP and sodium-ion batteries to reduce cost risks and integrate AI EMS to enhance competitiveness. Focus on long-term energy storage and VPP to generate multiple revenue streams (e.g., energy sales + capacity payments).

Market Expansion: Enter emerging states (e.g., Florida, Georgia) or mid-sized European markets and participate in utility tenders. Partner with solar installers to increase attachment rates.

In summary, while the US and European residential energy storage market faces policy turmoil in 2025, opportunities outweigh risks. Through strategic adjustments, Chinese manufacturers can capitalize on the global transformation wave. Feel free to share your insights in the comments section or contact us privately to discuss OEM cooperation opportunities! #EnergyStorage #RenewableEnergy