Global Residential Energy Storage Battery Demand in 2025: Regional Analysis and Strategic Responses to Market Dynamics

Global Residential Energy Storage Battery Demand in 2025: Regional Analysis and Strategic Responses to Market Dynamics

In the rapidly evolving energy sector, residential energy storage batteries represent a critical component for achieving grid resilience and sustainable power management. As a manufacturer specializing in scalable lithium-ion solutions, DQN Energy closely monitors global demand patterns to inform strategic positioning. Drawing from the latest 2025 market data, this post examines demand by key regions and outlines adaptive strategies for navigating economic fluctuations, policy shifts, and supply chain pressures.

Key Regional Demand Insights

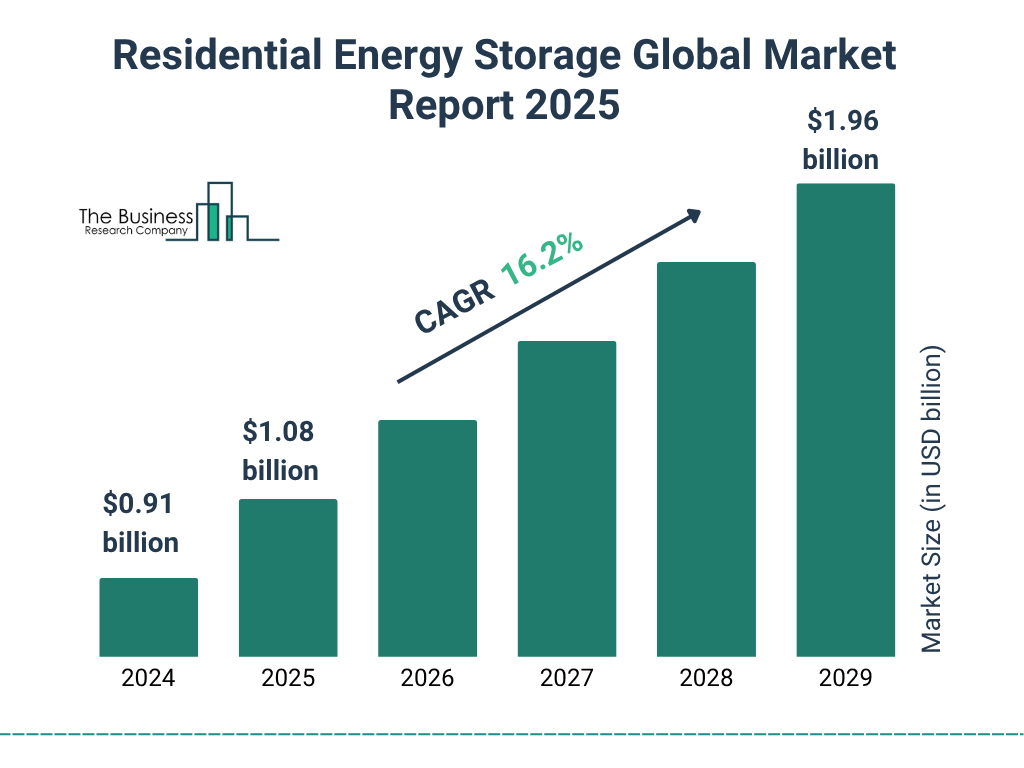

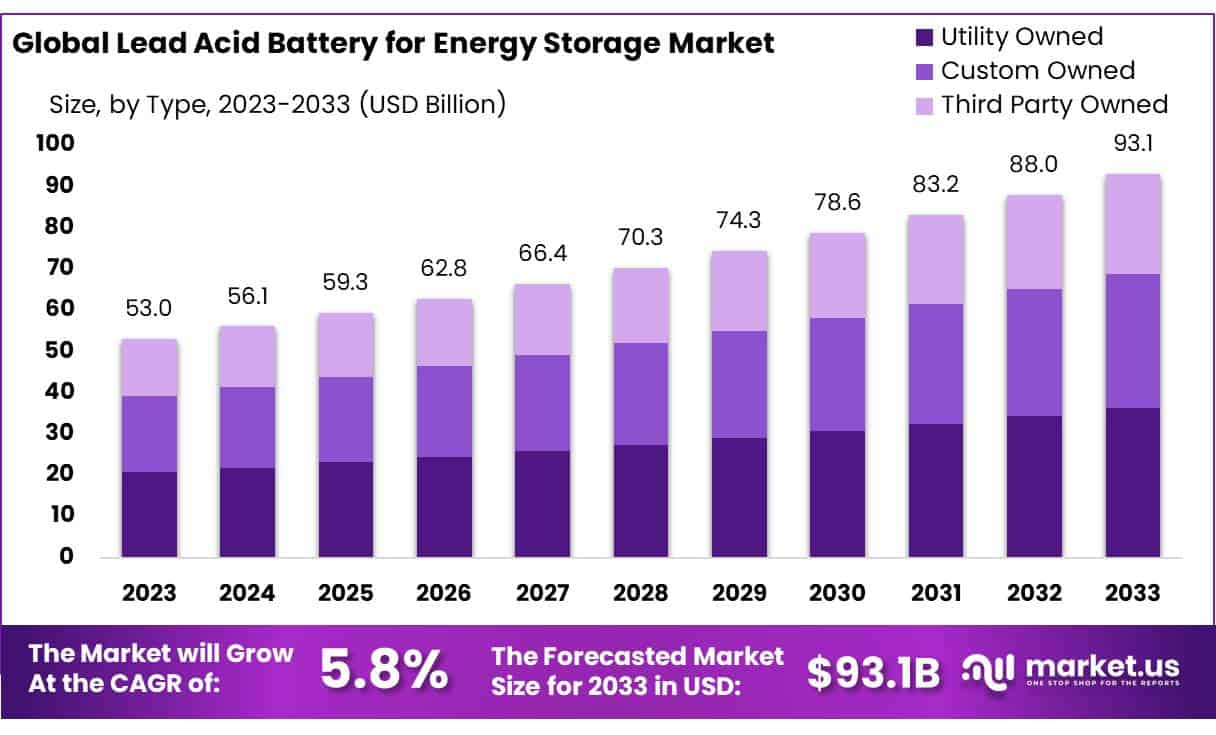

- Global Overview: The residential energy storage market is valued at USD 18.5 billion in 2025, projected to reach USD 68.0 billion by 2035 at a CAGR of 13.9%, with lithium-ion technologies dominating due to their efficiency and longevity. Overall, the battery energy storage system market grows from USD 6.89 billion in 2024 to USD 8.59 billion in 2025, reflecting a compound annual growth rate exceeding 24%. This surge is driven by rising electricity costs, renewable integration, and energy independence needs.

- Asia-Pacific (Leading Demand Hub): Accounting for 24% of the global market share in 2025, Asia-Pacific—led by China, India, and Australia—benefits from aggressive solar adoption and government subsidies. China's residential storage installations are expected to exceed 5 GW in 2025, fueled by domestic policies promoting distributed energy. India's demand grows at over 30% CAGR, supported by rural electrification initiatives.

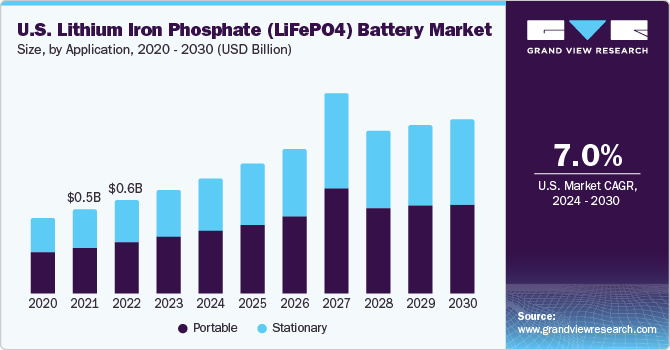

- United States (Policy-Driven Growth): U.S. residential solar added 1.1 GWdc in Q1 2025, though down 13% year-over-year due to NEM 3.0 impacts in California. Operating storage capacity reaches 37.4 GW by October 2025, up 32% year-to-date, with 19 GW under construction. States like Texas and Florida see accelerated demand amid grid instability, projecting 4 GW annual additions.

- Europe (Stabilizing Amid Challenges): Europe's utility-scale battery market nearly doubles in 2025, compensating for stagnation in behind-the-meter segments. Germany and the UK lead with over 2 GW residential installations, driven by EU Green Deal incentives. Overall, the region anticipates 10% solar PV growth slowdown but robust storage demand at 18.3% CAGR to 2035.

- Emerging Markets (High-Growth Potential): Latin America (e.g., Brazil) and Africa (e.g., South Africa) exhibit 25%+ CAGR, with the global ESS market reaching USD 8.6 billion in 2025. Off-grid applications in India and Sub-Saharan Africa drive demand, projected to add 1 GW annually amid energy access challenges.

Strategic Responses to Market Economics

To capitalize on these opportunities while mitigating risks like tariff hikes, supply chain disruptions, and economic volatility:

- Diversify Supply Chains: Shift towards multi-regional sourcing to counter policy uncertainties in major markets like the US and China, ensuring cost stability amid lithium price fluctuations (down 20% in 2025).

- Leverage Policy Timings: Align product launches with incentives—e.g., US ITC extensions or EU subsidies—targeting Q4 2025 for emerging market entries where demand peaks post-monsoon.

- Optimize Scalability and Localization: Invest in modular designs for rapid deployment, establishing local partnerships in high-demand regions like Asia-Pacific to reduce logistics costs by 15-20%.

- Risk Management in Volatile Economies: Monitor global battery market expansion (CAGR 16.4% to 2034) and hedge against downturns through flexible OEM models, focusing on markets with stable renewable growth like Europe.

These strategies position manufacturers to grasp market lifelines, turning demand surges into sustainable revenue streams.

What are your observations on regional demand shifts? Let's discuss how to navigate these dynamics—open to connecting on collaborative opportunities.

#EnergyStorage #RenewableEnergy #BatteryTechnology #SustainableEnergy #SolarPower #GreenTech #EnergyTransition #ResidentialEnergy #LithiumBattery #MarketAnalysis

LiFePO4 vs. Sodium-Ion Batteries for Energy Storage: Pros, Cons, and Future Trends

LiFePO4 vs. Sodium-Ion Batteries for Energy Storage: Pros, Cons, and Future Trends

2025 Global Home Energy Storage Battery Market: Which Voltage is Best - 12V, 24V, or 48V?

2025 Global Home Energy Storage Battery Market: Which Voltage is Best - 12V, 24V, or 48V?