2025 Global Home Energy Storage Battery Market: Which Voltage is Best - 12V, 24V, or 48V?

2025 Global Home Energy Storage Battery Market: Which Voltage Capacities Are Most Popular - 12V, 24V, or 48V?

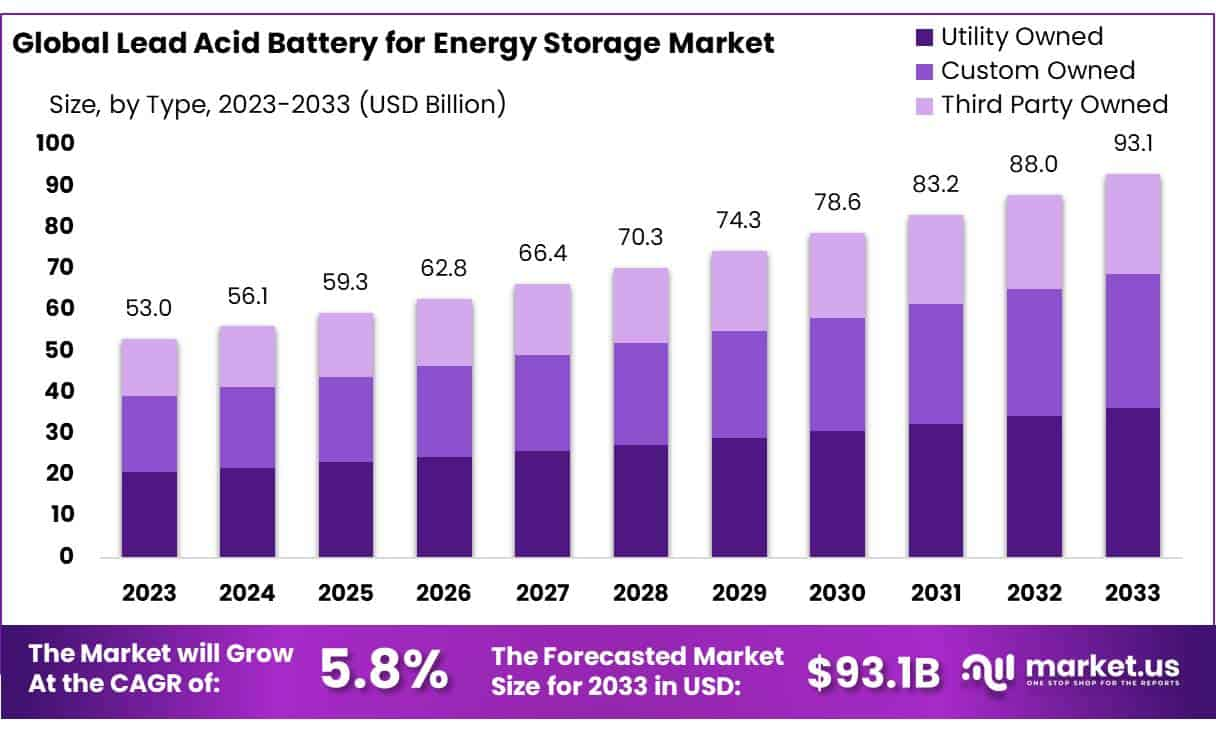

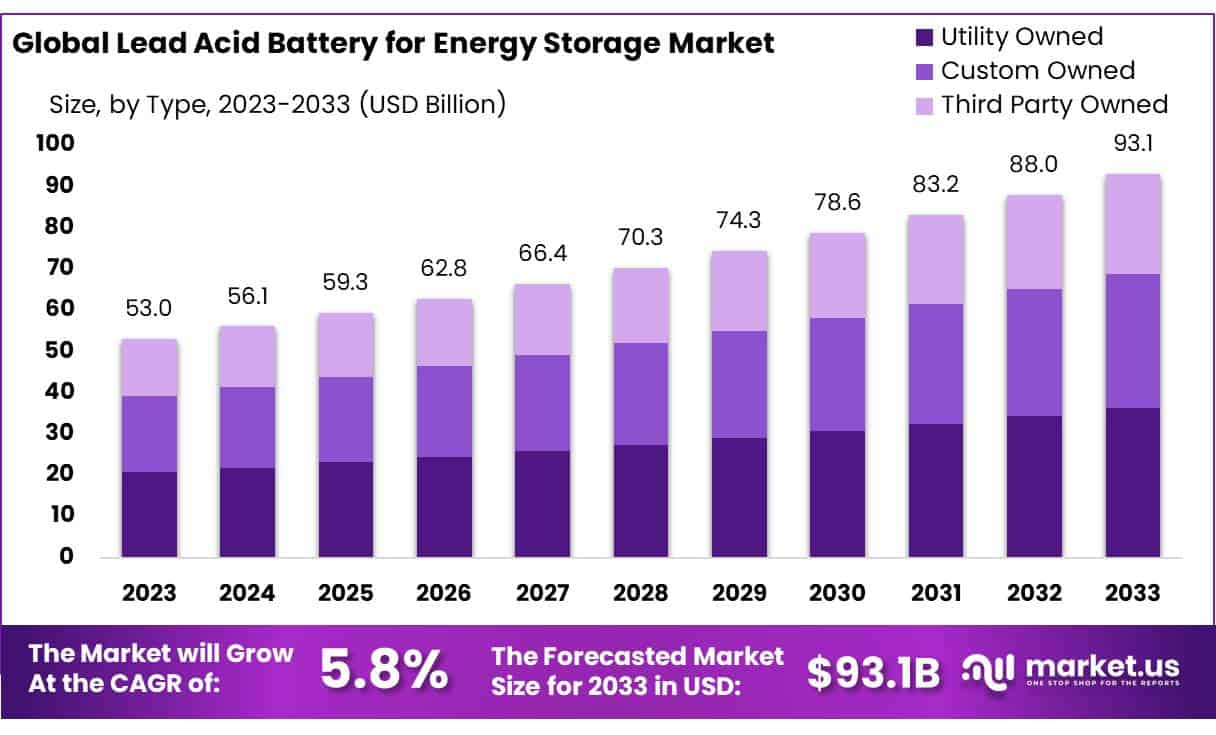

As a leading Chinese manufacturer specializing in OEM-customizable home energy storage batteries, we closely monitor global market trends to help our clients make informed decisions. The residential energy storage system (BESS) market is booming, projected to reach $14.35 billion in 2025 with a compound annual growth rate (CAGR) exceeding 20%, soaring to $47.12 billion by 2032. Voltage capacity—whether 12V, 24V, or 48V—plays a crucial role in system efficiency, cost, and compatibility. In this in-depth analysis, we break down the popularity of each voltage based on the latest industry data, helping you choose the right option for your home energy needs.

Understanding Voltage in Home Energy Storage Batteries

Home energy storage batteries store power from solar panels or the grid for backup during outages or peak demand. Voltage determines how efficiently the system handles power loads:

- Low Voltage (e.g., 12V): Ideal for small-scale setups with minimal power needs.

- Medium Voltage (e.g., 24V): Balances efficiency and cost for moderate households.

- High Voltage (e.g., 48V): Optimized for larger systems with high-power appliances, reducing energy losses.

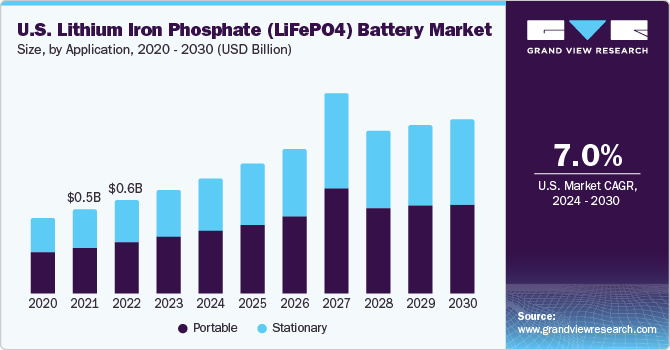

The shift toward higher voltages is driven by advancements in lithium-ion technology, which dominates the market at $32.37 billion in 2025. Let's explore which capacities are gaining traction globally.

12V Systems: Entry-Level Choice for Small Applications

12V batteries are popular in niche markets for compact, low-power systems under 1000W, such as recreational vehicles (RVs), off-grid cabins, or basic emergency backups. They hold a market share of approximately 20-30%, with the RV energy storage segment expecting 12V to maintain the largest portion due to its affordability.

Key Data and Insights:

- Market Share: 20-30% in residential BESS.

- Advantages: Low initial cost (often 20-30% cheaper than higher voltages), easy integration with existing 12V devices, and simple setup.

- Disadvantages: High current requirements lead to greater energy losses (up to 10-15% more than 48V), making it unsuitable for high-load appliances like air conditioners or refrigerators.

- Popular Regions: Emerging markets like Africa and Southeast Asia, where cost-sensitive consumers prioritize basic solar setups.

- Growth Projection: While stable in niches, overall adoption is declining as systems scale up, with a projected drop to 15% market share by 2030.

For manufacturers like us, 12V OEM options are ideal for entry-level products in developing regions, offering customization for solar-compatible tools.

24V Systems: Balanced Option for Mid-Sized Homes

24V batteries strike a middle ground, suitable for 1000-2000W systems in average households. They command a 30-40% market share and are commonly used in lithium-ion solar battery applications, providing better efficiency than 12V without the premium cost of 48V.

Key Data and Insights:

- Market Share: 30-40% in global residential storage.

- Advantages: Reduced current needs (halving losses compared to 12V), moderate cost, and compatibility with mid-range appliances like lighting and small electronics.

- Disadvantages: May require voltage converters for 12V devices, adding complexity and slight efficiency dips.

- Popular Regions: Europe (e.g., medium-sized homes in the Netherlands and Spain), where solar incentives drive hybrid systems.

- Growth Projection: Expected CAGR of 20% in mid-tier markets, but gradually shifting toward 48V as homes adopt more energy-intensive tech.

Our OEM services excel in 24V customizations, ensuring seamless integration with solar panels and electric tools for sustainable living.

48V Systems: The Mainstream Choice for Large-Scale Residential Use

48V batteries are the frontrunners for systems over 2000W, capturing over 40-50% of the market. They excel in efficiency and are increasingly standard in modern homes with high-demand appliances.

Key Data and Insights:

- Market Share: 40-50% and rising, dominating mature markets.

- Market Size Projection: The 48V battery system market is set to hit $7 billion in 2025, with a CAGR of 24.2% reaching $48.8 billion by 2034.

- Advantages: Lowest energy losses (efficiency up to 96%), supports heavy loads like EVs and HVAC systems, and scalable for stackable designs.

- Disadvantages: Slightly higher upfront costs (10-20% more than 24V), though offset by long-term savings.

- Popular Regions: United States (e.g., California hotspots) and Europe, fueled by energy independence policies and grid services.

- Growth Projection: Adoption rate could reach 70% in residential setups by 2030, boosted by lithium-ion advancements.

As experts in stackable 48V solutions, we recommend this for clients seeking long-term reliability and OEM flexibility.

2025 Market Trends and Opportunities

In 2025, 48V will be the most popular voltage globally, followed by 24V, with 12V relegated to specialized small-scale uses. This trend aligns with the lithium-ion battery market's expansion to $32.37 billion, emphasizing efficiency and scalability. Key drivers include:

- Rising solar adoption (global installations up 15-20%).

- Policy incentives like U.S. tax credits (up to 30%).

- Shift to higher voltages for better ROI (payback in 7-12 years).

For Chinese manufacturers, OEM opportunities abound in customizing voltages for diverse markets. If you're exploring home energy storage, contact us for tailored solutions.

Welcome to discuss trends or collaborate—let's power the future together!

LiFePO4 vs. Sodium-Ion Batteries for Energy Storage: Pros, Cons, and Future Trends

LiFePO4 vs. Sodium-Ion Batteries for Energy Storage: Pros, Cons, and Future Trends

2025 Global Home Energy Storage Battery Market: Which Voltage is Best - 12V, 24V, or 48V?

2025 Global Home Energy Storage Battery Market: Which Voltage is Best - 12V, 24V, or 48V?